In a digital world increasingly powered by artificial intelligence, AI-generated IDs are becoming sophisticated enough to fool traditional Know Your Customer (KYC) systems. As cybercriminals exploit outdated verification methods, businesses and financial institutions are left vulnerable to fraud, identity theft, and regulatory breaches. The solution? Robust data verification.

This article explores why data verification is the answer to outdated KYC practices and how it can effectively neutralize the threats posed by AI-generated identities.

The Rise of AI-Generated IDs

AI technology has advanced to the point where synthetic IDs can be generated with frightening realism. Deepfake images, manipulated documents, and even fake biometric data can easily pass standard KYC processes, especially those still relying on visual inspection or rudimentary document checks.

With the explosion of AI tools, even non-technical bad actors can create fraudulent IDs that slip through the cracks. These fake identities are then used for:

- Money laundering

- Opening fraudulent bank accounts

- Bypassing sanctions or AML regulations

- Conducting large-scale identity fraud

The Problem with Legacy KYC Systems

Traditional KYC processes were never designed to combat the level of deception AI now enables. Most legacy systems:

- Rely heavily on visual checks and document uploads

- Lack real-time cross-referencing with authoritative / government databases

- Are not equipped to detect synthetic or manipulated identities

- Often fail to verify the authenticity of data sources

This creates a dangerous loophole for financial institutions, fintechs, and online platforms that depend on outdated KYC software to meet compliance.

Why Data Verification Is the Solution

Unlike traditional document-based KYC checks, data verification cross-references user-provided information against authoritative, real-time databases. Here’s why it works:

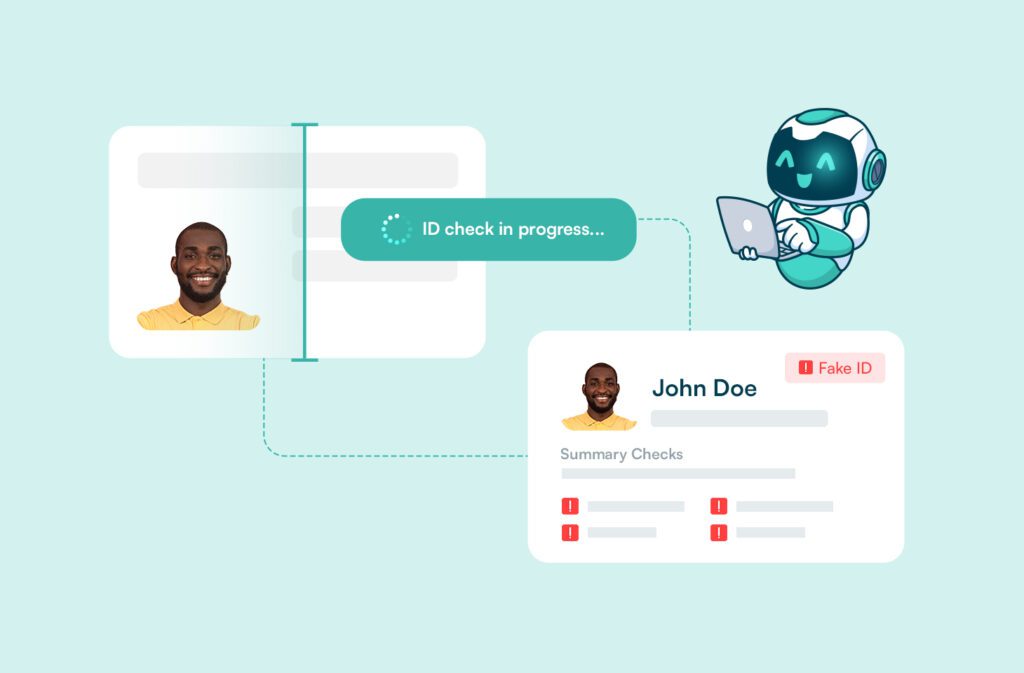

1. Detects Synthetic Identities

Data verification can flag inconsistencies across government, financial, and social records, making it nearly impossible for AI-generated IDs to pass as legitimate.

2. Real-Time Validation

Modern data verification tools provide instant feedback on the accuracy of user-submitted data — such as name, address, SSN, or phone number — directly from trusted sources.

3. Prevents Document Forgery

Since it doesn’t rely solely on images or uploads, data verification removes the dependency on potentially fake documents or doctored media.

4. Meets Global Compliance Standards

Robust data verification systems are built to satisfy AML, KYC, and GDPR regulations, ensuring businesses remain compliant while staying secure.

5. Enhances User Trust and Experience

By reducing the need for repeated document uploads and manual reviews, data verification streamlines onboarding while maintaining high security.

How Businesses Can Implement Data Verification

Adopting a data-centric identity verification strategy involves integrating with APIs and platforms such as Prembly Identity APIs that offer:

- Access to global government databases (single source of truth).

- Support for multi-factor identity verification

- Continuous monitoring for ongoing user risk.

The Future of Identity Verification Is Data-Driven

As AI-generated fraud evolves, so too must the tools we use to detect and prevent it. KYC systems that rely solely on static document checks are no longer sufficient.

To stay ahead of the curve, organizations must embrace data verification as the gold standard in identity protection — offering a faster, safer, and smarter alternative to archaic methods.